Technical Guide to Value Performance Marketing

Positioning an acquisition program to align with true business value is one of the most elusive achievements of performance marketing.

Welcome to the conversation. This is a newly launched discussion on business and product strategy driving parabolic growth. Please take a moment to provide feedback, share your thoughts, or pass along to your friends.

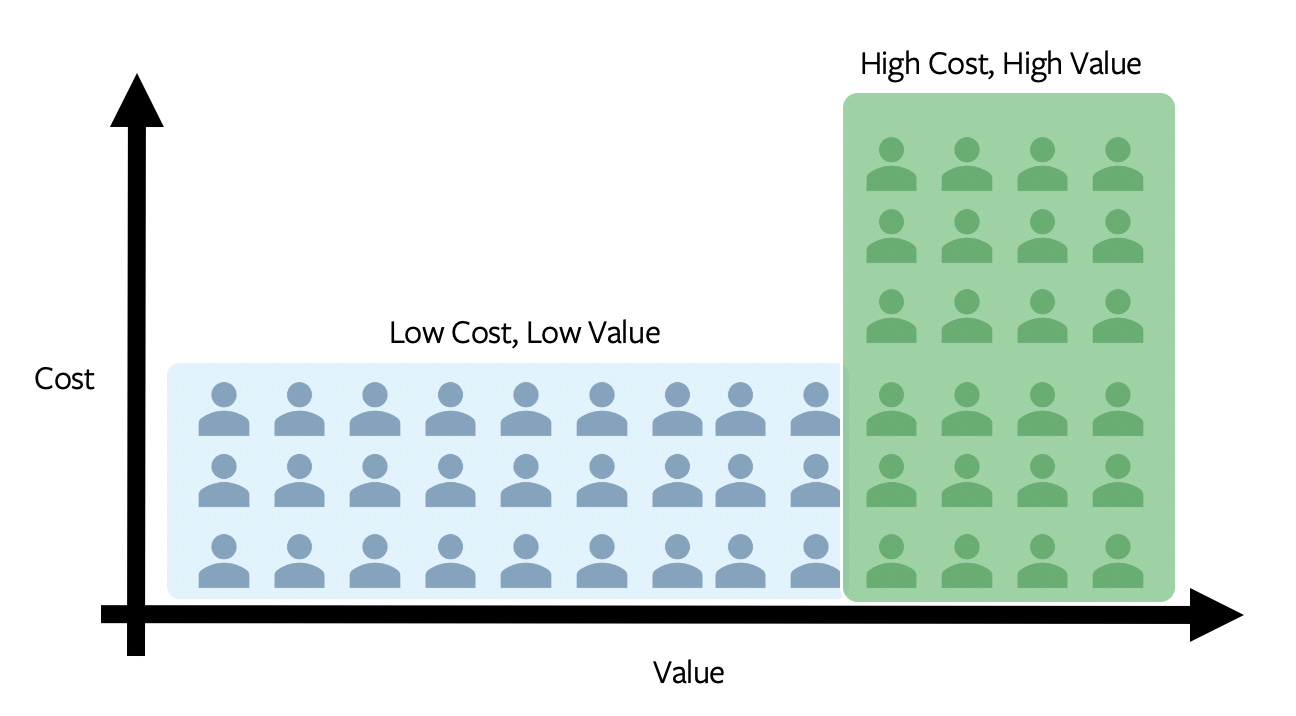

Positioning an acquisition program to align with true business value is one of the most elusive achievements of performance marketing. It is challenging enough to define business value as a singular metric, which is how platforms like Facebook optimize; making tradeoffs to drive better outcomes for single metric. Layer in the complexity of a businesses’ definition of value, and it makes it even more difficult to express that value to an ad platform and align whatever optimization options the platform has available to your unique definition of value. Facebook is a Lowest Cost bidding system, and with the exception of Highest Value, will bias towards driving the most outcomes for the least investment. Since this is an underlying mechanic in most acquisition programs, it is always important for advertisers to consider defining value and expressing value to the auction when there is significant variance in the value of user cohorts.

Here we will explore the different value levers advertisers have on Facebook, the limitations and advantages of each, and discuss how to evaluate whether a particular value strategy is right for you.

Word of Caution

Bidding for value is not the correct choice for many acquisition programs (retention is a different story for some). In many cases, driving lowest cost efficiency while maximizing volume is the right choice for many businesses, especially those that rely heavily on post-monetization levers, curating cohorts, and/or have LTV curves that require significant time to mature. In most cases, bidding for value is naturally more expensive on a CAC basis, and it is critical that businesses are certain that they can realize their LTV projections or redefine a channel’s value.

Levers for Value

Segmentation of Audiences

The most common and intuitive way to position an acquisition program for value is to populate a audience with higher value users and restrict delivery to that subset of the total user base.

These are uploaded to Facebook as Custom Audience lists, and are commonly exports of existing customers or lists purchased from a third party.

Pros (+):

Defined list, allowing pre-determination of value

Cons (-)

Restricted delivery

Requires ongoing maintenance as cohorts evolve or products change

The Verdict - Customer Lists are a good way to go for businesses operating a new acquisition strategy at small scale or where the return from the defined audience is known and static. This is most applicable for businesses where Conversion Rate and LTV are highly correlated, and the initial Conversion Rate of a user is the most heavily weighted in the LTV calculation. A downside of defined lists

LAL audiences create new audiences from a seed, and are a great way for businesses to expand to new, unknown users based on a list of known users.

Pros (+):

Expand to unknown users from a seed of predetermined value

Cons (-)

Restricted delivery

Requires ongoing maintenance as cohorts evolve or products change

Users are not populated based on relative value, but rather similarity to seed audience

The Verdict - Look-a-Like audiences suffer from the same downsides as Customer Lists, but are a natural evolution for businesses that exhaust existing, known audiences or need to expand from a seed.

VBLAL audiences combine the audience expansion of LAL audiences with the ability to define relative values for each user within the seed.

Pros (+):

Expand to unknown users from a seed of predetermined value

Define relative value within the seed to generate new audience biased towards higher value users first

Cons (-)

Restricted delivery

Requires ongoing maintenance as cohorts evolve or products change

Works best when the distribution of values is wide

The Verdict - VBLALs are the most friendly entryway for most advertisers into value bidding, especially if cohort LTV curves aren’t clearly defined or the advertiser hasn’t determined a ROAS goal. Many advertisers operationalize value based bidding using VBLALs and optimizing towards a CPA, allowing for lowest cost delivery against a new audience created based on users with the highest expected value.

Signal Segmentation

Segmenting signal is also effectively the segmentation of users, but instead of explicitly defining the users in a Customer List or a Seed Audience, Signal Segmentation allows advertisers to partition user actions and express them as different Events. Optimization towards these partitioned events in separate Ad Sets allows the advertiser to bid against subsets of user actions instead of subsets of users, removing the targeting restriction that comes from audience segmentation.

Pros (+):

Allows of broad targeting, increasing liquidity and total addressable audience

Draws mutually exclusive distinction between events of different values

Allows for Conversion Optimization (and thus post-View) and broad audience value bidding

Cons (-)

Each segmentation of signal requires enough conversion volume to drive optimization

Works best when user actions have binary values (e.g. high or low) versus a spectrum of value

Can be more difficult to implement if the Event defining value does not happen in-browser

Requires strong signal fundamentals

Optimizes towards a rolling 7D CPA

The Verdict - Signal Segmentation provides advertiser the ability to “target” through signal. This removes the need to restrict delivery through audience targeting, and unlocks broad audience delivery while still giving advertisers a lever to bias optimization towards higher value user actions. This signal lever allows advertisers to use Conversion Optimization and not Value Optimization, unlocking 1 Day Post-View optimization to drive additional scale. It’s important to note that this means the partitioned signal is now separated into two or more ad sets, each with a Lowest Cost bidding component, as visualized above. Each ad set drives the most scale at the lowest cost, meaning advertisers are optimizing towards a different 7 Day CPA instead of a 7 Day ROAS metric.

Value Optimization

Before we dive into what Value Optimization is, how it works, and the pros and cons, let’s take a look at how optimization capabilities on Facebook have evolved over time.

With the development of the Facebook Pixel and SDK, advertisers were given the ability to optimize for off-platform, cross device user actions, unlocking a race to the bottom as businesses continued to drive towards more down-funnel user actions at lower and lower CACs. Sophisticated advertisers used one or more of the levers mentioned above to segment their ad delivery at the Ad Set level, and mapped their cohort CACs to post-acquisition LTV curves, thus extending their ability to scale acquisition while managing their LTV/CAC goals.

With the creation of Value Optimization, advertisers were able to optimize towards ROAS instead of CPA. For most businesses, maximizing ROAS improved metrics across the board as the ad delivery began biasing towards higher and higher value users. What quickly followed was a rise in associated costs. For some, the Value Optimization product unlocked lasting scale and performance, while others saw a short-term boost in LTV/CAC that either flattened or degraded over time.

What happened? First we need to dive deeper into the mechanics of VO.

What does Value Optimization actually do?

A simplified explanation of Value Optimization is it adds another layer of machine learning to Conversion Optimization.

Instead of simply looking at Estimated Action Rate, it aims to predict:

Estimated Action Rate * Estimated Value

VO then gives advertisers the option to bid based on Return on Ad Spend through a few options:

Value with ROAS Control <-Compare To-> Lowest Cost with no Cost Control

Value with MinROAS <-Compare To-> Lowest Cost with Bid Cap

Highest Value

Highest Value with MinROAS

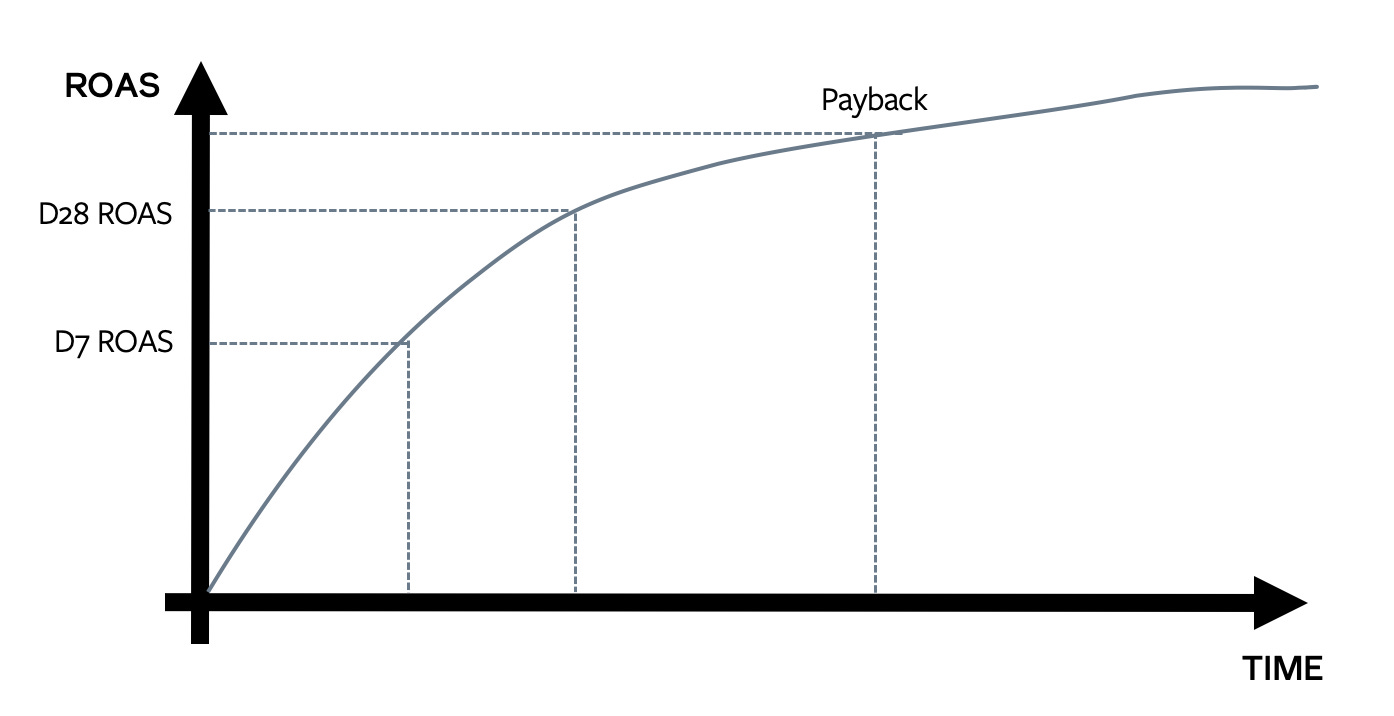

Like Conversion Optimization, Value Optimization is either maximizing volume at the best ROAS possible or maximizing ROAS over an optimization window, either 1D ROAS or 7D ROAS. This means that advertisers with value defining events that occur outside of the chosen optimization window or have a LTV/CAC definition that includes post-acquisition events should consider whether a 7D ROAS metric is an actual predictor or long term value, and the likelihood of actually realizing future value.

Pros (+):

Taps into machine learning to predict both estimated action rate and expected value

Can simplify acquisition when there are many cohorts or products of distinct value

Cons (-)

Cannot include View in optimization

Restricted to optimizing towards a 1 or 7 Day value metric

Requires distinctly different values

Does not work well with value events outside of optimization window

Higher up-front costs when optimizing for value may increase exposure with longer payback windows

Expected Payback based on 7D ROAS

Actual Payback Over Time

As illustrated here, there are dangers in optimizing for a 7D ROAS if cohorts have a longer period before realizing true value, or if the LTV curve begins to flatten out significantly over time. It’s also possible that the quality of users acquired when optimizing for a 7D value metric is actually not a predictor of value over time, as is the case with many businesses that nurture cohorts and monetize heavily post-acquisition.

Value Optimization can introduce further risk with advertisers that have lower conversion volume and high acquisition costs. Higher up front costs with the expectation of greater value over time increases the exposure to a flattened LTV curve if the cohorts take longer to payback.

The Verdict - Value Optimization is a powerful tool for businesses that can take advantage of the machine learning within the constraints of the product. It can be a fast way to jump start acquisition based on value, but businesses should be aware of both the limitations of the products and the exposure to risk with certain business models. Long term, optimizing towards a singular 1D or 7D value metric can come with higher costs or limit scale, depending on other components of the advertiser’s acquisition program.

Bottom Line on Value Performance Marketing

All advertisers should be thinking about value, but that does not mean jumping to Value Optimization simply because it optimizes for a singular Return on Ad Spend metric that is easy to digest and manipulate in-platform.

Success in positioning acquisition around value is:

Asking the channel to deliver the correct outcome - Is maximizing 7D ROAS truly the goal? Or would your business actually benefit at driving volume and maximum efficiency?

Determining how optimization performance metrics relate to business value - How does that 1D, 7D ROAS or CPA actually map to your LTV/CAC calculation?

Choosing the value lever(s) you pull to achieve 1) and 2) - Armed with an understanding of the underlying mechanisms and nuances of each of these products, how can we best deploy them to close the gap between optimization performance and business value? Are we able to express LTV or the most meaningful components of LTV to the auction? Is the system actually biasing ad delivery towards users or user actions that are causal to value?