Prepare for iOS14’s Privacy Protections

A new playing field presents businesses with a unique opportunity.

Welcome to the conversation. This is a newly launched discussion on business and product strategy driving parabolic growth. Please take a moment to provide feedback, share your thoughts, or pass along to your friends.

Disclaimer

This reflects my personal views and opinions only and is not a reflection of Facebook or any of Facebook’s employees. The implications of iOS14’s privacy protections are an ongoing conversation as ad platforms respond, and the recommendations and discussion below may not be relevant in the future. Official statements and updates from Facebook can be found on the Business Blog at www.facebook.com/business and I encourage readers to refer to the latest update on September 10th, 2020.

Apple’s iOS 14 privacy protections are no surprise to anyone with the amount of media coverage that has happened in the weeks leading up to the initial planned rollout for the September release of iOS 14.0.1, and the aftermath of Apple’s decision to postpone the privacy protection features to January 2021. We won’t rehash all the details at length, but instead will summarize the landscape so far and dive into how I’m working with my clients to prepare their businesses for what might be the largest signal loss event to date.

Have questions specific to your business, or want to chat further?

Find me at g@u13n.com

Short-list of Changes

IDFA or Identifier for Advertising, becomes opt-in for publisher access

Apple offers SKAdNetwork, it’s attribution service to publishers

Up 100 Campaign slots for targeting and measurement per app

Data observable only at the Campaign level, not the user level

Random delay introduced on attribution data

Last Click, 30-60D attribution windows

Who Should Care?

Any app advertiser or advertiser with exposure to app as a meaningful channel, especially North American app advertisers where iOS has 53% market share vs. 25% market share worldwide.

Businesses most impacted are likely pure play mobile gaming (Zynga, Glu, ...), app based eCommerce & marketplaces (Wish, OfferUp, …), and other industries with significant app user bases like Travel, Restaurants, Rideshare, Entertainment, Financial Services, … honestly anyone with an app-based service.

Preparing for Uncertainty

While advertisers were updated on September 10th, 2020 in the Facebook Business Blog post to hang tight as more details on the January rollout are released, many businesses with high exposure to app signal loss or had pure-play app businesses are still looking for ways to mitigate risk and position themselves for a completely different mobile app advertising world. Even with enormous uncertainty around what the privacy protections could look like in January and what Facebook will develop in the months leading up to the new year, there are immediate steps any business should take.

App Signal Loss Mitigation

Signal loss in the new iOS14 privacy world will largely be driven by the opt-in IDFA sharing change and Facebook’s decision to not collect IDFA at all. Losing this matching parameter can significantly impact the match rate of app events, which will impact attribution, targeting, measurement, optimization, and more.

(re)Designing for Advanced Matching

Passing Advanced Matching parameters is table stakes for many advertisers, who may be familiar with Auto Advanced Matching or Manual Advanced Matching for the Pixel. For most app advertisers, Advanced Matching was ignored since IDFA had always been a relatively foolproof way to match app events back to a user.

In fact, many app based services, including Uber, only require name and email to access their service.

Advertisers that are not collecting all of the Advanced Matching parameters below in their existing sign up or conversion flow must be considering ways to ask users for this data.

Fortunately for many advertisers that sell physical goods, collecting these data fields is common practice upon purchase, since Billing Address and Shipping Address forms will generally capture most of this information. That isn’t good enough.

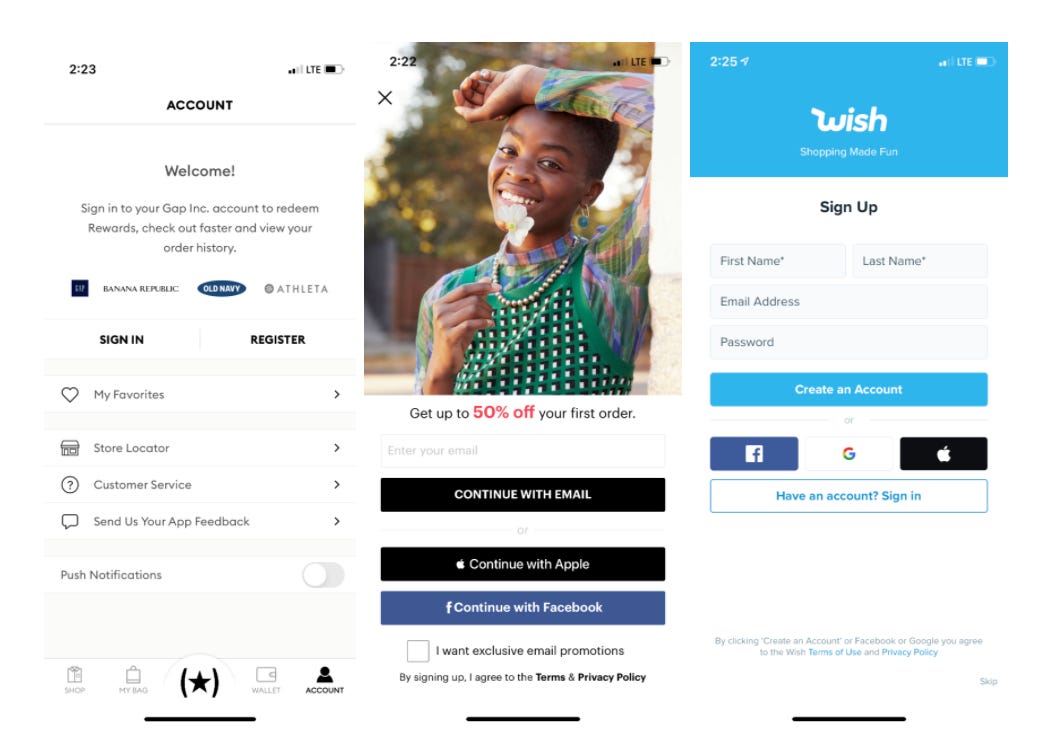

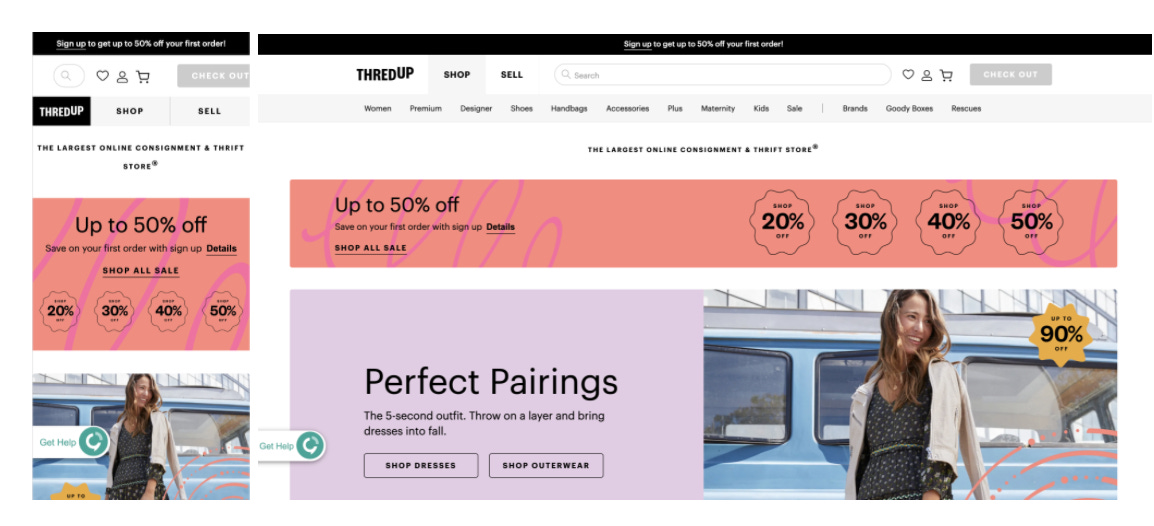

A top notch acquisition program requires event matching across the entire funnel, from app open all the way through conversion. Collecting all user data fields using a registration gated experience is the best way to ensure your app has all of these Advanced Matching identifiers to pass with subsequent events, allowing event matching to drive audience creation, retargeting, and optimization for all funnel events. Compare the apps below; Banana Republic allows for full browsing and add to cart without registration, thredUP asks for email upon app open but does not force registration before shopping, whereas Wish has gated access and requires registration (but only collects a subset of these fields!).

Redesigning your sign up flow and app experience to thoughtfully collect this data as early in the funnel as possible is critical to having these parameters available to pass with events.

Login with Facebook

An alternative (read: complementary recommendation) to redesigning the registration and login experience is to integrate Login with Facebook, which many apps have today.

Think Cross Channel

Every iOS and Android user is also an mWeb and Web user. In the same way that I often recommend advertisers always allocate investment to nascent channels because the initial investment has a great chance of being highly incremental and efficient as a result of new audience exposure, investing in cross channel has been a big unlock for traditional web businesses moving into app (e.g. Amazon) and app into web (e.g. Robinhood).

Pixel optimization has always been lower cost relative to App due to the larger addressable audience and abundance of signal. Pixel optimization also allows for post-view, which increases the scale most advertisers can achieve. In many cases, advertisers with omni-channel businesses see higher LTV from app users which can offset the higher acquisition cost, but my questions for these businesses are:

Does it really matter which channel you acquired the user on?

How frequently do users who sign up or make their first purchase on web move to app, and vice versa?

Is your business optimized to drive users from a low LTV acquisition channel (web) to a higher LTV acquisition channel (app)?

Wouldn’t it make sense to drive lower cost, higher volume acquisition on web first, and then use post-acquisition marketing (email, offers, etc.) to nurture your cohorts?

Let’s make sure we’re understanding the what we’re asking the acquisition program to do, and how that either aligns or does not align with the why.

Full mWeb + Web Experience

Omnichannel businesses, where a user can reasonably move through the funnel and access the majority of products and services on both mobile and web, should look to develop fully functioning app and web experiences.

Businesses that can develop and maintain a fully functioning mWeb and Web experience not only unlock strong mobile acquisition with Web signal optimized ads, but they are also providing a seamless cross-device experience without forcing users to download an app, which can frequently interrupt new user acquisition and increase costs.

Web to App Acquisition and App Store Optimization

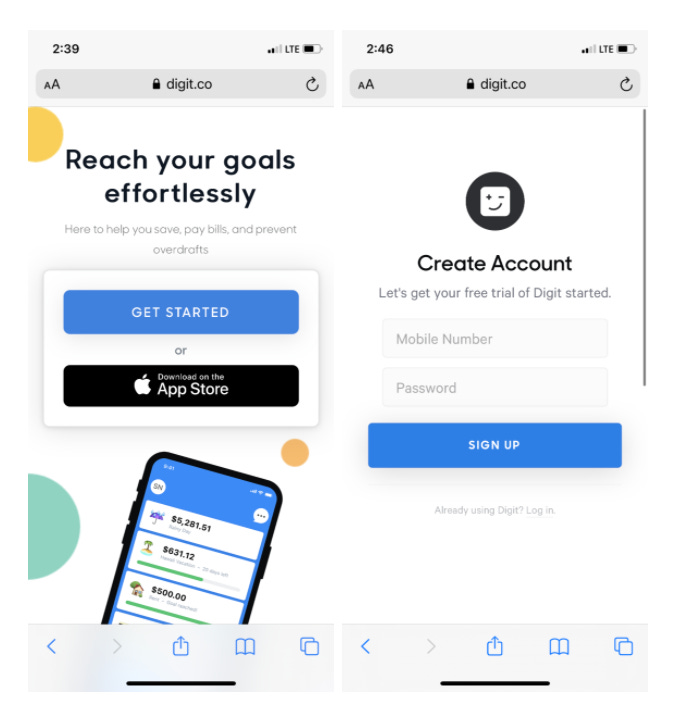

Not every business can operate a fully functioning mWeb or Web experience. This is especially true for businesses that are inherently mobile. For these types of businesses, which are typically app based services or mobile gaming, I strongly recommend creating an mWeb and Web friendly sign up experience, so users can complete registration and access a portion of services prior to downloading an app.

In the example above, Digit has created a dynamic landing page for the ads, which will drop a user onto an mWeb page that allows them to either sign up in mWeb, or redirect automatically to the app store for their device. Digit allows for full account creation on mWeb but a user needs to download the app in order to access the full product, which is a mobile native service.

An alternative to this is creating an App Store-esque experience, which allows for pixel optimization and lands a user on a replacement of the iOS or Android app store.

I expect for mobile gaming publishers like Zynga, Glu, etc. to invest in an mWeb version of a game library, similar to Steam or Origin, that allows for a single point of registration and remarketing for users to download new titles. Perhaps this would allow for advanced demo functionality with longer videos or web-embedded game previews that aren’t available features in an app store.

Cross Channel Optimization

For advertisers who are new to omnichannel, or have not historically invested in mWeb or Web acquisition, taking advantage of existing cross channel optimization is a good introduction to seeing what cross channel performance could look like in the remainder of 2020.

For eCommerce advertisers, the Catalog Sales Objective is inherently cross channel, and takes into account both web and app signals to drive outcomes.

For all other advertisers, Cross Channel Optimization is in the works, and allows for advertisers to optimize for Conversions across iOS, Android, and Web within the same ad set.

Invest in Web Signal Resiliency Early

Hopefully by now readers are considering building a web and mWeb experience, or are looking into improving the one they already have, whether it is a fully functional experience or a web acquisition funnel.

We will explore browser signal resiliency in more detail in the future, but all advertisers with web signals should absolutely be implementing Conversions API.

Bottom Line on Preparing for iOS14

The reality is that the privacy protection controls are coming, and they will be disruptive. We know that signal loss for app events is imminent, and we know that ad platforms like Facebook will not have the same ad optimization, measurement, and targeting capabilities for iOS14 that we have access to today.

Advertisers that can face that truth will realize that half the battle will be contending with whatever capabilities ad platforms can offer on ad optimization and targeting, and the real opportunity lies in exploiting business model advantages where they exist (omnichannel, Login with Facebook, registration gating) and finding opportunities to mobilize quickly once the playing field is leveled.

The Silver Lining - Apple’s privacy protections have effectively taken mobile app advertising back half a decade. Suddenly the highly sophisticated advertising programs operated by large, entrenched advertisers is as dumb as the bootstrapped marketing program that college student’s startup is operating.

Everyone is subject to upper funnel optimization. Everyone has limited ability to target, measure, and operationalize data. Everyone is limited to 100 ads (if not less). How are you planning to take advantage of this leveled playing field?