What. A. Week! Early vaccine deployments, monster IPOs, crazy updates from Disney, and acquisitions abound. Christmas is coming but the news never stops! Thanks as always for reading - join the conversation and find me at twitter.com/garrisonyang_ or at linkedin.com/in/garrisonyang

ICYMI - My Posts & Convos

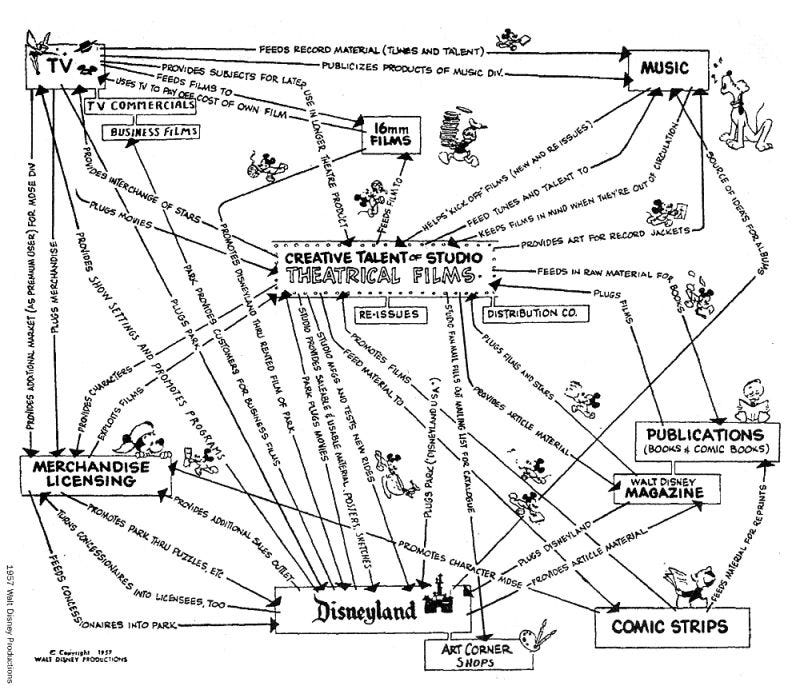

Disney adds over $75Bn in market cap following their 2020 investor day, including huge expansion of original IP and beating Disney+ growth numbers by 4 years! This ‘Disney-tization’ flywheel plan from Walt Disney drawn in 1957 still rings true, almost 70 years later. Read more

Airbnb IPO’d this week, with share prices soaring to almost double the original $68 / share price to a high of over $165 / share. At well over $100Bn in market cap, Airbnb is more valuable than Marriott, Hyatt, and Hilton.. Combined. Read more here

New @ Facebook

Updates

Shopping in Reels is launching Thursday, December 10. Reels with product tags let brands and creators drive product discovery with entertaining, short-form content that has the opportunity to be seen on Instagram’s global stage. Businesses and creators who have set upInstagram Shoppingwill be able to tag products when they create reels on Instagram, and people viewing a reel with product tags will be able to tap ‘View Products’ to buy, save, or learn more about products tagged in that reel.

We have released a helpful guide teaching businesses how to leverage Facebook performance marketing solutions and how to maximize their media, creative, and measurement.

On Wednesday (December 9th), Facebook is launching enforcement improvements to the Cheating and Deceitful Practices ads policy to enforce on ads that incentivize users to review products in exchange for free products. To go hand in hand with the updated enforcement, Facebook will be updating the external policy page to include an example around this enforcement of deceitful practices.

Facebook is releasing the 2021 Topics and Trends Report From Facebook IQ, our annual feature of conversation topics that grew on Facebook and Instagram. This year, we cover 12 major global trends across 8 countries including hybrid shopping, DIY fashion, and community activism. Use this to help your clients discover which topics are taking hold in conversations across Facebook and Instagram and are on the cusp of going mainstream in the year ahead.

Consumer Tech & Culture

Google to lift post-election political ad ban on Dec 10. The ban began after polls closed on Nov 3 and was originally expected to last for at least 7 days after Election Day to limit post-election misinformation. According to Google, it no longer considers the post-election period to be a sensitive event.

Just Eat offers benefits to 1,000+ UK workers. The benefits include hourly wages, sick pay, and pension contributions, setting a new precedent for the gig economy. It plans to hire 1,000+ such workers in London by the end of March, with more UK cities to follow next year. The group already takes a similar approach in other European markets.

Google Stadia users can now livestream directly to YouTube. The long awaited functionality is live and couldn’t have come at a more important time with the service’s most important game yet, Cyberpunk 2077, arriving this week. The game could be the single biggest opportunity yet for Google to prove what its service can do.

Google will allow you to turn off ads for alcohol and gambling. Starting with YouTube in the US, users will be able to toggle off ads for alcohol and gambling. The company said that it would add the option to its ad settings controls, which already allow people to turn off targeted advertising altogether.

FireEye was breached by nation-state hackers. The cybersecurity firm was hacked in what it said was a highly sophisticated foreign-government attack that compromised its software tools used to test the defenses of its thousands of customers. There is no evidence so far that data belonging to its customers had been compromised.

Apple announces $549 AirPods Max headphones. They will have similar features to AirPods, such as noise cancellation and quick pairing to iPhones. They are expensive for headphones (competitor products cost ~$350), but this may come down to cost of materials (e.g. stainless steel headband). They are expected to launch on Dec 15.

Xiaomi has rebranded itself as a local manufacturer in India. Unlike Chinese competitors Oppo and Vivo, Xiaomi has pursued a unique and potentially high-risk strategy in India. It has talked up its all-Indian local leadership team and thousands of jobs in manufacturing and retail amidst rising anti-Chinese sentiment.

France fines Google $120M and Amazon $42M for dropping tracking cookies without consent. France’s data protection agency, CNIL, found that tracking cookies were automatically dropped when users visited Google.fr or Amazon.fr in breach of the country’s Data Protection Act. Google and Amazon have defended their commitment to privacy.

Google to investigate exit of top AI ethicist. CEO Sundar Pichai apologized for the company’s handling of the departure of AI ethics researcher Timnit Gebru, who said she was abruptly fired last week after sharing a list of demands in relation to being refused permission to attach her name to an AI ethics paper that had been accepted for publication.

Business & Investing

Cisco acquires IMImobile for $730M. In addition to the UK-based cloud communications software company, Cisco is also acquiring Slovakia-based virtual event moderation startup Slido. The acquisitions come as Cisco CEO Chuck Robbins seeks to add more networking software and services to its product portfolio.

Airbnb goes public with market cap of $86.5B. Shares were originally priced at $68, but closed the first day of trading at $144.71, more than double the valuation it sought. The first-day surge made Airbnb the 10th best debut in 2020 based on price gain from its IPO, and puts its market cap ahead of competitors Booking ($86B) and Expedia ($18B).

DoorDash goes public with market cap of $60.2B. A day after pricing at $102, DoorDash soared 86% to $189.51. DoorDash has fared well during the pandemic, as evidenced by its 268% YoY revenue growth in Q3, though its valuation is currently 17x revenue (compared to 7-8x for Uber and Lyft).

Uber sells self-driving unit to Aurora, valuing it at $10B. Aurora Innovation, an autonomous vehicle startup backed by Sequoia Capital and Amazon, is acquiring Uber ATG in a deal that will value the company at $10B. Uber is handing over its equity in ATG and investing $400M in Aurora, giving it a 26% stake in the combined company.

MassMutual joins the Bitcoin club with a $100M purchase in another show of mainstream acceptance of the alternative currency. This comes before a week of relatively weak Bitcoin performance as it slis below the $18,000 mark.