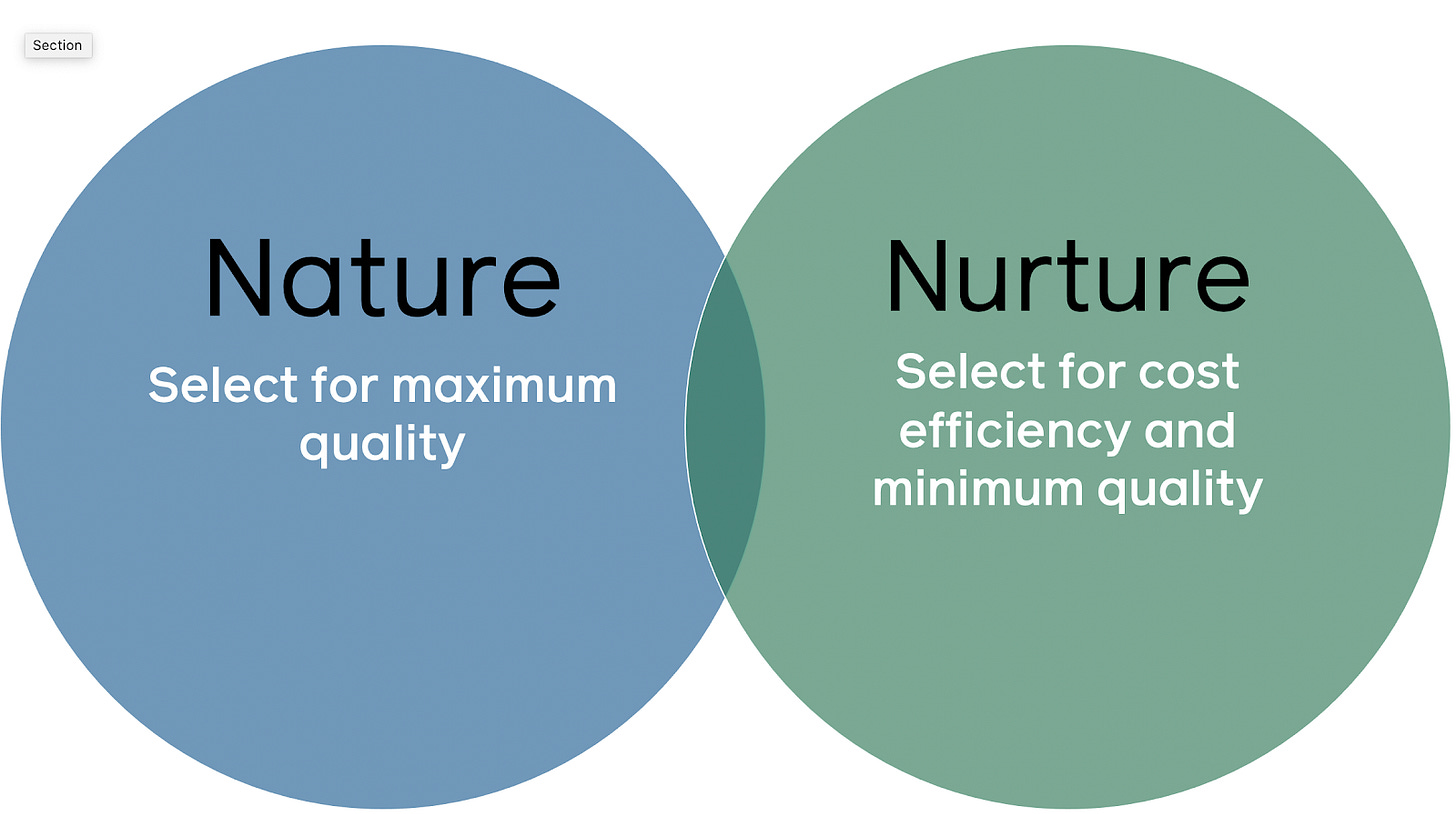

(Acquisition) Nature vs. (Retention) Nurture

Your retention strategy (or lack thereof) is limiting your acquisition strategy.

Welcome to the conversation. This is a newly launched discussion on business and product strategy driving parabolic growth. Please take a moment to provide feedback, share your thoughts, or pass along to your friends.

Unlike other forms of advertising, digital advertising commonly includes auction or bidding components in pricing. As advertisers compete, optimizing for high value, low frequency events quickly becomes expensive. Advertisers are paying a premium for the high ROAS purchase or the high pLTV cohort of users, and due to the real time auction nature of platforms like Facebook, advertisers often can’t predict a range of acquisition cost when optimizing for these outcomes. This presents a tough choice between nature and nurture.

An (extra long) Intro

Sophisticated machine learning models and what I believe the academics call a shitload of data have allowed ad platforms giants like Facebook and Google to monetize attention and give advertisers one of the holy grails of marketing - the opportunity to deliver ads based on predicted action rate to a semi-captive audience. Following in the footsteps of the two giants, other platforms like Pinterest, Snapchat, TikTok, and Twitter have developed their own analogs to serve down funnel, direct response advertisers.

In fact, we’ve seen a growth in advertising channels where each incremental impression delivered is more expensive, and a decline in advertising channels where volume is inversely related to cost.

Ad buyers know that while TV and other traditional media tend to offer volume discounts, advertisers who are consistently spending in the 6 or 7 digits daily on digital platforms will start to see exponential increases in their CPMs, all else equal. This cost increase is due to competition for a finite inventory of eyeballs, and advertisers are willing to pay this premium for digital impressions over traditional for one reason: they are more valuable.

The physical attributes contributing to higher effectiveness of a digital impression vs. a tv impression aside (you can’t click your TV to buy something), digital impressions have inherent value because of their relevancy. As it turns out, having a ton of data is helpful in developing highly sophisticated machine learning models to find out what ad, when, to who, and where on your feed is going to have the highest statistical chance of ending in a positive outcome for the advertiser.

Over time, advertisers moved from Reach to Likes and eventually to where we are now. Send an action, attach a value, and platforms like Facebook will go find more people who are likely to take the same action at a certain value, all within the advertisers cost constraints. As the ML improved, so did its ability to support increasingly complex acquisition programs, creating an opening for increasingly complex businesses to be successful in acquiring users through direct response marketing.

Where once only lower price point, single transaction business models were truly scalable, we now see all sorts of businesses scaling and acquiring users sustainably on Facebook, from Fintech (Robinhood, Chime, SoFi) to HealthTech (GoForward, Ethos) to Marketplaces (thredUP, Poshmark, The RealReal) to all sorts of subscription (ButcherBox, Stitchfix, Calm). These are businesses that are disrupting their industries with new business models that emphasize retention and post-acquisition monetization, allowing them to gain market share through breakeven or unprofitable acquisition, and then farm value from continued engagement and repeat purchases over time.

In our Technical Guide to Value Performance Marketing, we discussed a number of ways these advertisers are using advanced strategies to express their customers’ LTV to the auction, a better way to scale acquisition if the value defining event (repeat purchase, paid subscription, etc.) occurs outside of Facebook’s 7 day optimization window.

We also discussed the exposure to risk advertisers have if their paybacks are long, and their LTV calculations have margin for error.

Unlike other forms of advertising, digital advertising commonly includes auction or bidding components in pricing. As advertisers compete, optimizing for high value, low frequency events quickly becomes expensive. Advertisers are paying a premium for the high ROAS purchase or the high pLTV cohort of users, and due to the real time auction nature of platforms like Facebook, advertisers often can’t predict a range of acquisition cost when optimizing for these outcomes. This presents a tough choice between nature and nurture. Advertisers are faced with a few options:

Acquire users at lowest cost, highest volume

Conditionally acquire users at lowest cost

Acquire the highest value users

There are situations that call for any of the three, or even a combination of the options together, but the most important consideration is the quality (or user qualifications / proxy parameters) that the advertiser requires for acquisition. Do we want to pay for users who are high quality by Nature or do we want to scale on lowest cost and Nurture value from our users?

Nature; Maximum Value with a Maximum Cost

Businesses that pay for users with maximum value by nature are common in consumer products. In fact, any business that is operating a first purchase profitable acquisition strategy is selecting users with a minimum quality, since they want each initial transaction to pay for itself.

For businesses that either acquire at breakeven or at a loss, the decision is more complex.

The most intuitive answer is that we should acquire users that demonstrate maximum profitability or value at the outset - these users have the highest initial LTV, and thus should have the highest likelihood of paying back over the long term.

However this strategy can be expensive and can limit a businesses’ ability to scale, depending on the minimum quality required for acquisition, and how long the payback expectations are. Businesses operating on longer expected paybacks or have longer gaps between repurchases (e.g. six months to a year) will find it challenging to find users that are likely to payback immediately, or users who have high initial conversion value, especially at any level meaningful scale or cost efficiency. Businesses also change frequently, especially companies with a frequently changing assortment of products like big box retailers (Walmart, Amazon, eBay) or marketplaces (thredUP, DoorDash, Uber, Airbnb).

In a best case scenario, the advertiser can drive stronger, shorter paybacks by optimizing for near-term value, at the expense of higher acquisition costs and limitations to scale when costs start to rise.

In a worst case scenario, the advertiser ends up acquiring users unprofitably at a high initial value, hoping for a higher likelihood of payback, but the users never actually break even.

Many business models with a single, infrequent or recurring monetization event (services, subscription businesses, high price point products), can also find this acquisition strategy limiting. These businesses have built in positive engagement feedback loops that increase the value of the service to the user as engagement or time of use increases. In general, the growth teams should be considering a strategy centered around maximum scale combined with nurturing increased value from the user over time.

Nurture; Maximum Efficiency with a Minimum Value

The cost to acquire higher value users tends to be greater than the cost to acquire lower value users. This is inherently a function of there being less higher value users and the lower frequency of higher value actions.

The question isn’t whether we should pay a premium for those users, since we should always scale higher value acquisition within an appropriate cost, it’s a question of what initial value (or cost control) we want to use to limit the delivery system, and what signal (or indicator of quality) we want to provide the system.

Acquisition teams are limited by the optimization window of the ad platform. Using the 7 day window on Facebook as an example, the system will try to drive outcomes within 7 days based on the cost or ROAS controls provided. For businesses that have payback goals or value defining events that are on a longer scale, say 30 days, marketing teams have to guess what initial acquisition value is likely to lead to the outcome they want. For longer time frames or complex businesses, signal loss compounds, since the initial value or user qualities of the acquired cohort may not be as strong of an indicator for the future behavior or value of the users.

The problem for advertisers isn’t necessarily defining value, it’s defining predicted value, since everything boils down to a signal or a cost control in the 7 day window that has a statistical likelihood to pay back in the future. As advertisers evaluate ways to signal predicted LTV or assess what D7 cost and ROAS goals to bid for, they are faced with a singular problem - for these different cost control and user value variations, what is the available opportunity, and what is the elasticity of cost?

The Pricing Problem

Marketing teams looking to balance quality, scale, and efficiency are faced with the challenge of unpredictable pricing and scale. Since ad platforms like Facebook operate real time auctions, pricing and availability of opportunity are subject to market conditions - competition from other advertisers, changing user sentiment, seasonality, and other factors - leading to difficulties predicting what efficiency and scale are available on a daily basis, even with the simplest business models. This means advertisers will ultimately have to test combinations of user value signals with combinations of cost controls to get to a place where scale, efficiency, and user quality make sense.

Bottom Line - Manage Risk and Know Your Users

The success of your growth strategy is a function of how strong product market fit for your product is. A large component of that is the ability for your product or business to retain and monetize users after acquisition.

Having levers to nurture users after acquisition will relax the constraints on acquisition - instead of driving maximum value or extremely strict user qualities initially, businesses have the freedom to define minimum values or loose user qualities in their acquisition strategy. These users can grow into being higher LTV users as they engage with and use the product.

Your retention strategy (or lack thereof) is limiting your acquisition strategy. Front loading LTV expectations into the initial conversion or near-term events makes acquisition expensive and limits scale. Whether this is a business model restriction, lack of data, or inability to define post-acquisition value, unlocking the option to acquire users of varying initial and future values not only increases the ability to scale acquisition, but also de-risks the marketing program. When a retention or post-acquisition program can successfully nurture users to become valuable to the business, initial acquisition requirements can be loosened, and costs will come down.